With the purpose to promoting small earnings into a savings, PPF has initiated in the year of 1968. It is the superlative way to enjoy the better returns with the minimum tenure period of 15 years. It has become the most excellent one and has become the favorite savings for the investors to enjoy the taxation system. Simple in words, PPF is also known as savings with high rate. In fact, interest rate will be added on your total savings on every month so that you can enjoy the safe investment options. If you are the one who doubts on calculating the rate, then make use of the ppf calculator and sure you will receive the results you are expecting!!

What is PPF Calculator?

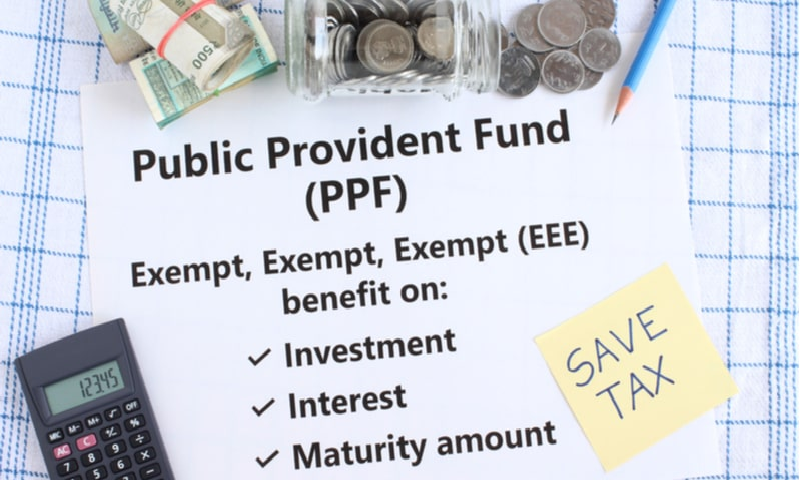

PPF is a type of mutual fund scheme known for Public Provident Fund. In order to initiate the small investments into an asset with bonus benefits of tax, PPF has been initiated. It is the superlative way to make a retirement amount. With the help of the PPF, you can enjoy harmless returns. The sum to be invested will be calculated based on the interests earned that are all tax-free. In order to enjoy the scheme, an individual should pay the contributions with a minimum lock-in-tenure of 15 years. And also, it can be absolute up to 5 years in advance.

With the help of PPF, you are free to pay Rs. 500 and so you will benefit a tax rate of Rs. 1,50,000. Of course, an investment can be made lump total with the term of 12 payments. For the years of 15, you are allowed to make a deposit once in a year. And also, it is simple and easy to open PPF account. All you need to do is pick the application and fill the necessary details along with Aadhaar KYC key, individuality proof, address verification, and much more.

How does PPF can be calculated?

When it comes to opening an account, you are free to open a bank financial account in any authorized nationalized banks and Indian Postal Office. At the same time, some other private banks are offered you a great way to open an account. It is an easy way to calculate the total to be received. By means of ppf calculator, you can easily calculate the sum in an easy way. And sure, the total can be calculated to gain the PPF returns on the year-wise. With a specific period of time, PPF financial credit can be determined online and so you will come to know how much sum is available on your financial credit.

In addition, you will come to know huge information such as interest rate, total to be withdraw, taxation offers and a lot more! As a whole, investment payment is low when compared to other mutual schemes. The results which are provided by the PPF calculator online includes many current data in order to know the potential PPF rate and so you need to be aware of amount deposited, interest earned and much more!!